Why Sustainable Technology Matters More Than Ever

Why Sustainable Technology Matters More Than Ever

In an era when climate change, resource scarcity, and consumer demand for green solutions are all intensifying, sustainable technology is no longer a niche. It’s becoming core to the global economy. According to one recent study, the green-technology sector (around 3,100 companies) grew about 8.9 % last year and attracted thousands of patents and grants. Meanwhile, global investment in clean energy technologies is expected to hit around US$2.3–3.3 trillion in 2025–26 in preparation for the net-zero transition.

So why should you care?

- For everyday users: greener tech means cleaner cities, fewer pollution-related health issues, and often lower utility bills.

- For small business owners: adopting sustainable technologies can reduce costs, open new green-market opportunities, and give a competitive edge.

- For students and innovators: the green tech startup ecosystem is growing, offering potential for careers, entrepreneurship, or investment.

Here’s what matters: technologies that solve big environmental problems and scale affordably will define which startups succeed in 2026 and beyond.

What Defines a Sustainable Technology Startup

When we talk about “sustainable technology startups,” we mean companies that combine environmental impact, scalability, and technological innovation. Here’s a simple table to unpack the problem-space:

| Problem | Green Tech Solution | Global Impact |

|---|---|---|

| Fossil-fuel power generation | Renewable electricity + storage | Lower carbon emissions, cleaner air |

| Waste and resource inefficiency | Circular economy models (reuse, recycle) | Less landfill, less resource mining |

| Inefficient cities/buildings | Smart-city systems, energy-efficient design | Reduced energy use, lower bills |

| Hard-to-abate industries (cement, steel) | New materials, direct-air capture, hydrogen | Enables decarbonisation of heavy industry |

| Lack of transparency in supply chains | AI/IoT monitoring, traceability | Builds trust, reduces hidden emissions |

In short: a sustainable tech startup should measure impact, innovate beyond current solutions, and scale from pilot to global relevance.

For 2026, investors and founders alike are watching for:

- Clear metrics (e.g., tonnes CO₂ avoided)

- Business models that aren’t just “good for the planet” but financially viable

- Tech that can leap across geographies or industries

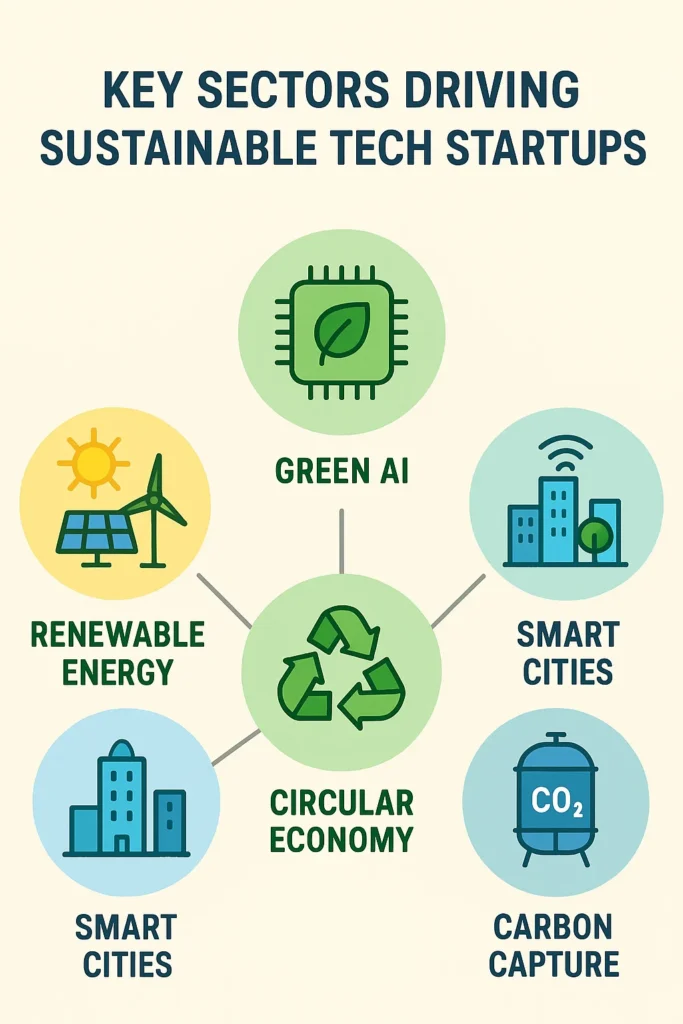

The Leading Green Tech Sectors Shaping the Future

Renewable Energy Innovation (Solar, Wind, Hydrogen)

Renewable electricity remains at the heart of the transition. For example, in the U.S., solar and storage made up 83 % of new capacity in the first nine months of 2025.

Even with headwinds (policy shifts, supply-chain pressures), 2026 looks like a rebound year as developers move to capture incentives and shift to digital tools.

Circular Economy Startups (Recycling, Waste-to-Energy)

We’re seeing more startups transform waste streams into value whether via novel materials, reuse platforms, or bio-based replacements. The market is still under-penetrated, which means major opportunity.

Sustainable Construction and Smart Cities

Buildings account for a big share of global energy use. Smart sensors, efficient HVAC, and retrofits are no longer “nice to have” they’re cost-effective today. Smart cities also integrate mobility, grids, and data to optimise resources.

AI and Data for Environmental Optimisation

Data is enabling ‘smarter-green’: AI models forecast energy demand, optimise usage, detect leaks, and manage supply chains for carbon risk. These tools help companies manage their carbon footprints, not just reduce them.

Carbon Capture and Climate Tech Ventures

Technologies like direct air capture, green hydrogen, and carbon utilisation are advancing. While still capital-intensive, the next few years will test scaling. For example, a cost-benefit analysis showed a benefit-cost ratio of ~1.41 for an AI-driven platform linking mobility, renewables and grid management over 2026-35.

Top Sustainable Technology Startups to Watch in 2026

Here are eight startups (and sectors) that show strong promise heading into 2026. Note: These are examples not exhaustive and you should research each further if you’re considering partnerships or investment.

1. GreenT (USA) – Property Climate Compliance Platform

What they do: GreenT offers a platform for property owners to track energy use, manage climate-regulatory compliance, and avoid penalties.

Why they matter: Buildings often lack clear dashboards. A scalable platform like GreenT can serve thousands of facilities and reset how real-estate handles carbon.

Fix/usage tip: For property owners, adopt such dashboards early regulatory pressure will increase in 2026.

2. earthbot.io (UAE) – Net-Zero Platform & AI Database

What they do: They compile climate-tech solutions into a searchable, AI-powered database, tailored for enterprises seeking green tech partners.

Why they matter: The barrier to adopting green tech is often knowing what’s out there. Platforms like this accelerate adoption globally.

Fix/usage tip: For SMEs exploring sustainable upgrades, use such platforms to scan viable vendors, not just Google-search them.

3. CarbonSifr (UAE) – Scope 1–3 Emissions Platform

What they do: CarbonSifr enables companies to measure, reduce and even remove CO₂ emissions across scopes 1–3 (direct, indirect and supply-chain emissions).

Why they matter: Supply-chain emissions are increasingly under scrutiny (e.g., by regulators and investors). Tools that bring transparency win.

Fix/usage tip: Supply-chain managers should engage now 2026 will see more mandates on scope-3 reporting.

4. Deep Sky (Canada) – Direct Air & Ocean Capture

What they do: Deep Sky develops DAC (direct air capture) and DOC (direct ocean capture) facilities, targeting large-scale removal of atmospheric CO₂.

Why they matter: Carbon removal is a missing piece of achieving net-zero, especially beyond 2030. Early movers may dominate supply.

Fix/usage tip: For corporations setting “net-zero by 2035” goals, partnering with removal startups means locking future credits now.

5. Yayzy (UK) – Climate FinTech Carbon Tracker

What they do: Yayzy offers a consumer-facing app and a B2B API that tracks individual or business purchasing behaviour and calculates CO₂ footprints, enabling offsets or greener choices.

Why they matter: Sustainability is personal too. FinTech integration is one way to embed green habits and data into daily spending.

Fix/usage tip: Small business owners can use such tools to share footprint data with customers building trust and green credentials.

6. Earthena (UK) – AI Analytics for Sustainability Decisions

What they do: Earthena combines financial, operational and climate data to produce insights for organisations seeking to integrate sustainability into core strategy.

Why they matter: Data-driven sustainability means linking ESG to profit metrics that’s critical for scaling.

Fix/usage tip: For students and professionals looking to join green tech, companies like Earthena are ideal interfaces between business and tech.

7. STEP4 (Turkey) – Supplier-Network ESG System

What they do: STEP4 offers systems to standardise sustainability data across supplier networks especially for companies operating globally with many tiers of supply.

Why they matter: Global brands face more pressure to audit their entire supply chain. Scaling this is complex STEP4 addresses that.

Fix/usage tip: For small manufacturers supplying larger brands, aligning with such networks now can open access to bigger contracts.

8. Redwoods.ai (USA) – Autonomous ESG Compliance Agents

What they do: They deploy autonomous AI agents that monitor, report and manage ESG compliance across supply chains and operations.

Why they matter: Manual compliance is costly and error-prone. Automation will reduce cost, speed up reporting, and become industry standard by 2026.

Fix/usage tip: Tech-savvy operations managers should evaluate compliance automation software now rather than later first-mover advantage matters.

The Role of Green Investment and Policy

Funding and policy are twin levers driving the green-tech rise.

- Venture-capital and investor interest remains strong: The green-technology industry averaged US$19.8 million per funding round, with 800+ rounds captured in one report.

- On policy: Regulatory shifts in 2025/26 will reshape economics. For example, U.S. tax incentives for renewables are changing, and new sourcing rules for wind/solar supply-chains may raise costs but also create opportunities.

- Macroeconomic environment: The global GDP growth rate is projected to slow to ~2.9 % in 2026, so green-tech must perform in less-frothy conditions.

For small business owners and founders, this means:

- Timing matters: Technologies that clear regulatory hurdles or leverage incentives early will benefit.

- Choose resilient models: Startups and adopters should avoid relying solely on subsidies.

- Data-driven metrics rule: Investors care about measurable impact, not just “green promises”.

The Future Outlook: Where Sustainable Tech Is Heading

Looking ahead to 2030 and beyond:

- Smart cities will integrate mobility, grid and building data with sensors everywhere and decisions made in real time.

- AI will not just optimise usage but enable new materials, recycling flows and circular-economy platforms.

- Carbon capture and utilisation (CCU) will move from pilot to industrial scale enabling heavy industries (steel, cement) to decarbonise.

- Green computing and digital infrastructure: As AI/data-centres expand, so do demands on sustainable power and materials.

- New markets: Emerging economies will leapfrog older infrastructure, creating new green-tech hubs beyond the usual suspects.

Expert insight: According to StartUs Insights’ “Green Technology Report 2026”, the industry supports ~244,000 employees and has >2,700 patents indicators of both scale and innovation.

My view: The paradigm shifts now taking place mean that by 2030, all tech companies will become at some level “green tech companies”. The winners in 2026 will be the ones that align climate-impact, scalable business models and digital leverage today.

How You Can Support or Join the Green Tech Revolution

Whether you’re a small business owner, student, or aspiring founder here’s how to engage:

- For business owners:

- Conduct an energy-audit: identify inefficiencies and low-hanging green tech wins (e.g., LED, rooftop solar).

- Partner with a tech startup: select one of the platforms above (or local equivalent) to improve sustainability reporting or operations.

- Communicate your green credentials to customers and stakeholders.

- For students / professionals:

- Develop skills in sustainability analytics, green-software tools, or climate-tech product management.

- Join or build a startup in a niche green-tech vertical (e.g., supply-chain transparency, circular materials).

- Stay updated on policy and investment trends these drive opportunities.

- For founders / investors:

- Choose business models with both impact and path to scale.

- Prepare to navigate shifting policy/regulation (taxes, sourcing rules, carbon markets).

- Build metrics early: e.g., “tonnes CO₂ avoided per user” or “energy kWh saved per dollar invested”.

Practical Checklist: Evaluating a Sustainable Startup

Here’s a quick printable-style checklist to evaluate a green technology startup or partnership:

- Does the company have clear impact metrics (e.g., CO₂ tonnes avoided, resource saved)?

- Is the underlying technology truly innovative, or just a repackaged idea?

- Can the solution scale globally (or at least regionally) within 3–5 years?

- Is the business model viable without massive subsidy reliance?

- Does the company integrate data/analytics (key for traceability, reporting)?

- Are there credible partnerships (industry, academia, government)?

- Is the regulatory/policy environment favourable or coming into favour?

- Does the startup align with real market pull (customer demand) rather than only “nice to have”?

Use this list before investing, buying, or joining a green-tech initiative.

Final Thoughts Before You Try It Yourself

The world in 2026 is entering a critical phase of sustainable-technology scale-up. The startups that matter will be those that combine real impact, digital-enabled scale, and financial sense. For everyday users, small businesses, and students, aligning with this shift now offers real gains whether cost savings, career opportunities, or competitive advantage.

If you’re thinking of investing in, partnering with, or working at a sustainable-tech startup, pick one that ticks the boxes above. The green-tech wave is not coming it’s here. And your choices today set your position for the next decade.

Why Sustainable Technology Matters More Than Ever

Why Sustainable Technology Matters More Than Ever